At the end of the fiscal year, financial statements are prepared (and are often required by government regulation). Adjusting entries requires updates to your 2021 guide to digital marketing for accounting firms specific account types at the end of the period. Not all accounts require updates, only those not naturally triggered by an original source document.

Customer Service

- Some nonpublic companies may choose to use cash basis accounting rather than accrual basis accounting to report financial information.

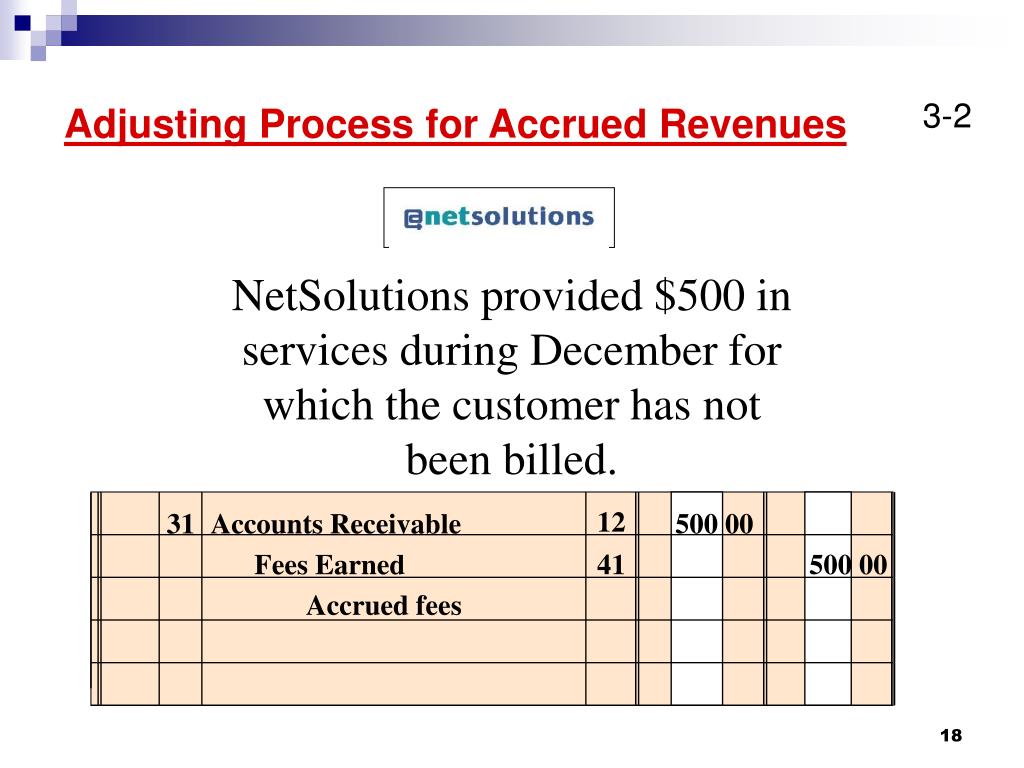

- Accrued revenues might relate to such events as client services that are based on hours worked.

- These cuts have more connective tissue, which breaks down during the slow cooking process, resulting in tender and flavorful meat.

- As soon as the asset has provided benefit to the company, the value of the asset used is transferred from the balance sheet to the income statement as an expense.

Some examples include interest, and services completed but a bill has yet to be sent to the customer. Insurance policies can require advanced payment of fees for several months at a time, six months, for example. The company does not use all six months of insurance immediately but over the course of the six months. At the end of each month, the company needs to record the amount of insurance expired during that month.

Illustration of Prepaid Rent

In all the examples in this article, we shall assume that the adjusting entries are made at the end of each month. One fundamental concept to consider related to the accounting cycle—and to accrual accounting in particular—is the idea of the accounting period. The accrual method is considered to better match revenues and expenses and standardizes reporting information for comparability purposes. When a company purchases supplies, it may not use all suppliesimmediately, but chances are the company has used some of thesupplies by the end of the period.

Need help preparing for an exam?

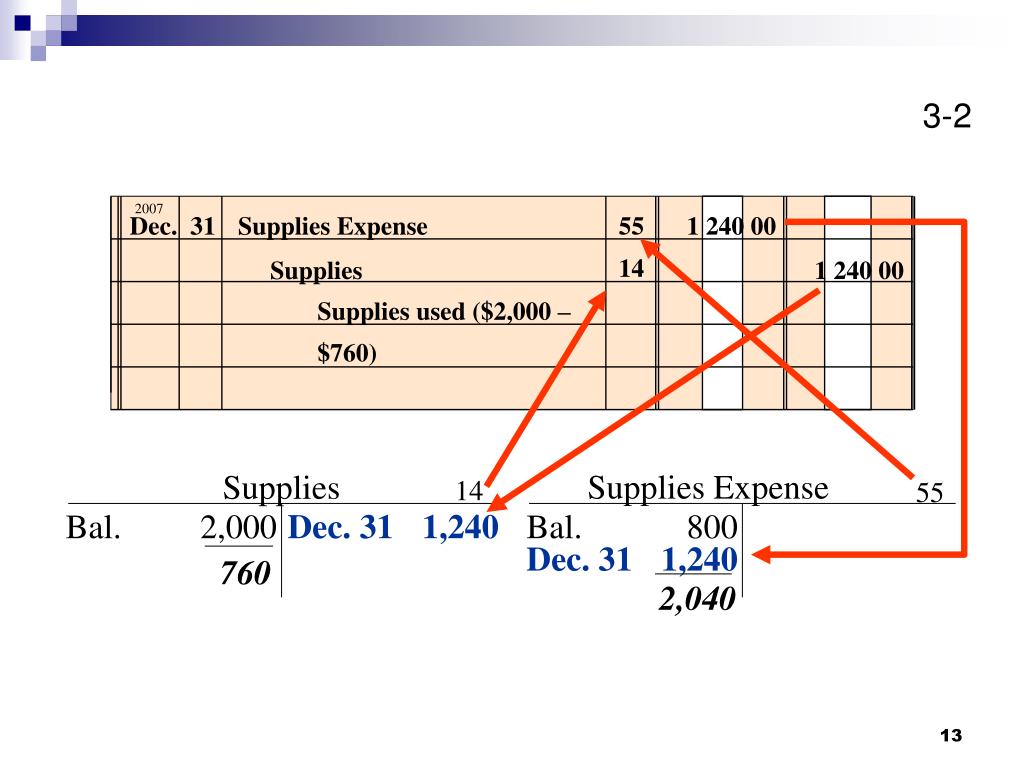

Recall that depreciation is the systematic method to record the allocation of cost over a given period of certain assets. This allocation of cost is recorded over the useful life of the asset, or the time period over which an asset cost is allocated. The allocated cost up to that point is recorded in Accumulated Depreciation, a contra asset account. A contra account is an account paired with another account type, has an opposite normal balance to the paired account, and reduces the balance in the paired account at the end of a period. Let’s say a company paid for supplies with cash in the amount of $400. At the end of the month, the company took an inventory of supplies used and determined the value of those supplies used during the period to be $150.

How the Accounting Cycle Works

Following the steps of analyzing transactions, recording entries, posting to ledgers and creating the trial balance the accounting cycle continues with steps 5-7 of the accounting cycle. Usually to rent a space, a company will need to pay rentat the beginning of the month. The company may also enter into alease agreement that requires several months, or years, of rent inadvance. Each month that passes, the company needs to record rentused for the month. Depreciation may also require an adjustment at the end of theperiod. Recall that depreciation isthe systematic method to record the allocation of cost over a givenperiod of certain assets.

Timing of the Accounting Cycle

One might find it necessary to “back in” to the calculation of supplies used. Assume $200 of supplies in a storage room are physically counted at the end of the period. Since the account has a $900 balance from the December 8 entry, one “backs in” to the $700 adjustment on December 31. In other words, since $900 of supplies were purchased, but only $200 were left over, then $700 must have been used. You will learn more about depreciation and its computation inLong-Term Assets.

You can also consider cooking the roast on low for a few hours and then switching to high for the last hour to speed up the cooking process. Next, heat a skillet over high heat and sear the roast on all sides until it’s browned. Once the roast is browned, place it in the slow cooker and add your desired aromatics, such as onions, carrots, and celery. When selecting a roast, look for one with a good balance of fat and lean meat. The fat will help keep the meat moist and add flavor during the cooking process. You can also consider using a bone-in roast, as the bone will add flavor to the dish.

According to the accrual concept of accounting, revenue is recognized in the period in which it is earned, and expenses are recognized in the period in which they are incurred. Some business transactions affect the revenues and expenses of more than one accounting period. For example, a service providing company may receive service fees from its clients for more than one period, or it may pay some of its expenses for many periods in advance. All revenues received or all expenses paid in advance cannot be reported on the income statement for the current accounting period. They must be assigned to the relevant accounting periods and reported on the relevant income statements. Also, companies, public or private, using US GAAP or IFRS prepare their financial statements using the rules of accrual accounting.

The accounting cycle focuses on historical events and ensures that incurred financial transactions are reported correctly. The accounting cycle is a methodical set of rules that can help ensure the accuracy and conformity of financial statements. Computerized accounting systems and the uniform process of the accounting cycle have helped to reduce mathematical errors. When a company purchases supplies, it may not use all supplies immediately, but chances are the company has used some of the supplies by the end of the period.