With Mosaic, SaaS companies can easily track revenue backlog and view all other crucial metrics in tandem, truly understanding what’s happening with the business. However, revenue backlog isn’t tied to a specific period — it’s based on contracted revenue. Even though revenue backlog isn’t usually a part of financial reports, investors often look at this metric to understand the company’s long-term financial viability and guide valuation. The presence of backlog can lead to delayed delivery of products or services, increased lead times, escalated project costs, reduced team morale, and decreased customer satisfaction. Unresolved backlog items can accumulate over time, exacerbating the problem and hindering the organization’s ability to adapt to changing market dynamics. Backlog management is not a one-time endeavor but an ongoing process that requires continuous monitoring and improvement.

Best Practices for Managing Revenue Backlog

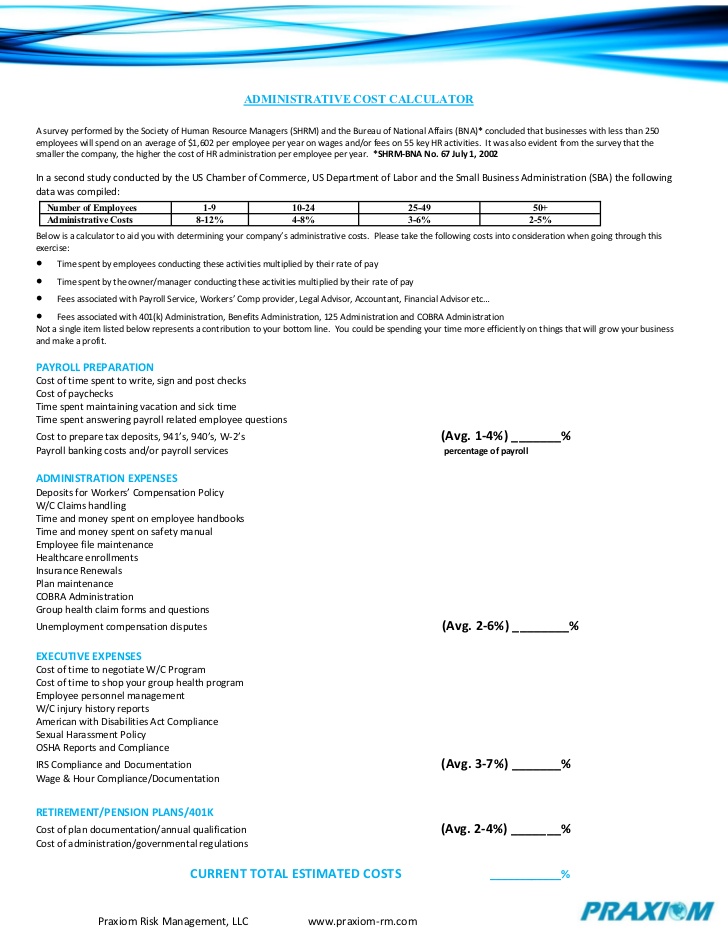

It includes revenue of all types that a company expects to get from contracts it has already signed, but that they have yet to invoice for or receive. For instance, a small business may have plans to launch a new product line or expand into a new market, but if it is struggling with revenue backlog, it may not have the funds to do so. Revenue backlog can strain finances and reduce profitability, making it difficult to invest in growth opportunities or meet financial obligations. In addition, it can lead to increased debt and interest payments, which can further strain finances.

- It’s a term that reverberates through various industries, from software development to manufacturing to finance itself.

- Revenue backlog can also hinder growth and expansion, as businesses may be unable to invest in new projects or expand their operations until the backlog is cleared.

- If a company has a backlog of product orders, it can simply mean that sales and demand are up.

- This delay in cash inflow can create challenges in maintaining adequate liquidity for daily operations.

By conducting a market analysis, businesses can identify new opportunities for growth and develop a plan for diversifying their revenue streams. Identifying the root causes of backlog is essential for implementing effective mitigation strategies. In simple terms, a backlog is a list or inventory of work that needs to be completed. It is commonly used in project management to keep track of tasks, but it can also be applied to personal finance. A financial backlog can include a range of tasks, such as debt repayment, investment planning, budgeting, and saving for specific goals.

Unlocking Potential: How In-Person Tutoring Can Help Your Child Thrive

In the case that such a provision is broken, the contract typically can be cancelled with no penalty to either the home builder or home buyer. In that case, backlog doesn’t convert to enrolled agent vs cpa revenue and instead gets removed with no other impact to the financials. If a company has a backlog of product orders, it can simply mean that sales and demand are up. For example, a business may set up an alert system that notifies them when a customer’s payment is overdue by a certain number of days. This allows them to follow up with the customer and address any issues before they escalate into a revenue backlog.

What is a Backlog in Project Management?

For free cash flows instance, in agile software development methodologies, a product backlog comprises a prioritized list of features, enhancements, and bug fixes yet to be implemented. A backlog could mean that a business may be unable to meet demand or that operations are inefficient. This means that you have a lot of work in the pipeline, which means your capital is tied to all that unfinished production.

It involves identifying backlog items, determining their priority, allocating resources, and tracking progress to ensure timely completion. Understanding the underlying causes of backlog is essential for devising effective strategies to mitigate its impact. Backlogs can stem from a multitude of factors, both internal and external to the organization. Common causes include inadequate resource allocation, scope creep, dependencies on external stakeholders, technical challenges, ineffective prioritization, and fluctuations in demand or workload. Identifying the root causes of backlog enables organizations to implement targeted solutions and prevent its recurrence.

In essence, backlog encapsulates the aggregate of all pending tasks or work items that haven’t been completed yet. However, to grasp its nuances and implications fully, we need to delve deeper into its different dimensions and applications. It can pertain to a company’s workload buildup, whether financial paperwork must be completed, a backlog in sales order fulfillment, or production capacity. Sectors that commonly deal with backlog include manufacturing, software development, and construction. Backlogs may also apply to companies that develop products/services on a subscription basis, such as SaaS (software-as-a-service) providers.

Identifying key revenue sources that contribute to backlog

Sprint backlogs are created during the sprint planning meeting, where the development team commits to completing the selected items within the sprint duration, typically ranging from one to four weeks. The sprint backlog provides a clear plan of action for the development team and serves as a guide during the sprint. In the dynamic realm of finance and project management, understanding the concept of backlog holds paramount importance. It’s a term that reverberates through various industries, controllers career guide from software development to manufacturing to finance itself.